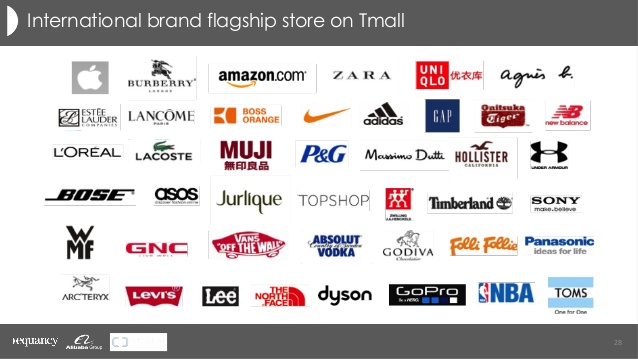

More than 14,500 foreign brands from 63 countries are selling on Chinese eCommerce platforms, and more than half of these brands have their presence on Tmall International platform. Two major reasons for this emergence of foreign brands on Chinese eCommerce platforms are: growing demand of foreign products, and relaxed policies on consumers purchasing personal items from foreign website.

2016 Tmall Global Top-Selling Countries

Rank Country Best-selling categories Market share

1. Japan Beauty/diaper/skincare 19.3%

2. U.S. nutrition/formula milk/bag 18.3%

3. South Korea Beauty/Skincare/apparel 13.6%

4. German Food/Kitchenware/Nutrition 8%

5. Australia Nutrition/Food/Coffee 7.9%

Best-Seller Categories on Chinese e-Commerce Platform

Chinese consumers prefer beauty products, baby diapers, apparel and skincare products from Japan and South Korea.

- Among product categories from the United States of America, Chinese consumers prefer nutritional supplements and baby milk formula.

- Germany and Australia are famous for kitchenware, nutritional food items, and coffee.

- Alcohols beers made in U.S ,wines from France and Italy.

- Fastest growing product category is: Children Supplies, Business Supplies, Cosmetics and Snacks.

Whereas foreign brands account for around 10% of China’s overall retail market, they make up 40% of goods sold online. If you look at categories such as wine, imports account for 85% of sales online. Even milk, where just 1% of domestic sales happen online, 30% of import sales are on eCommerce platforms. That is why China’s big eCommerce players such as Alibaba and JD are busy opening up offices across Europe, North American and Australasia.

There are 198 prefecture-level cities in China with population bigger than Manchester. Although most of these cities don’t have the discretionary income of cities like Shanghai or Beijing, they are China’s fastest growing cities, with consumers having an increasing appetite for new and foreign goods. Many of these foreign goods are difficult to get at the local mall, but eCommerce platforms opens up a whole new range of products.

How can foreign brands have presence on Chinese e-commerce platform?

Depends on the product categories it is prompting, foreign companies need to have online presence on one or more Chinese eCommerce platforms.

Tmall.com & JD.com

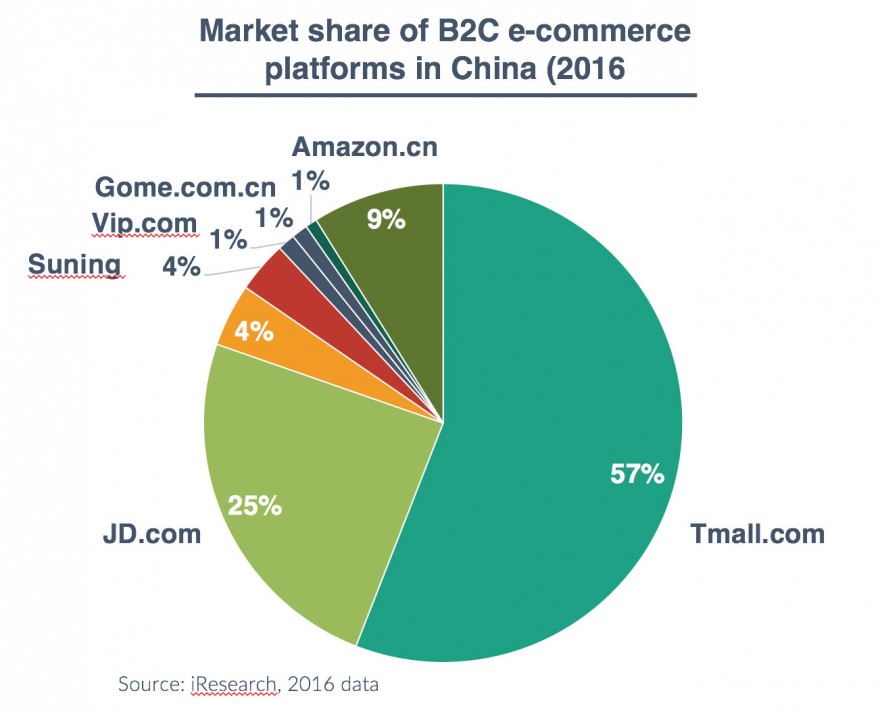

Tmall holds the biggest market share in eCommerce market in China at 57%. It is also the most expensive online marketplace in China, as Tmall mainly focuses on premium brands. Tmall allows International brands to open exclusive online stores and directly sell products to Chinese consumers without having bricks-and-mortar stores in China. Small has invitation-only policy where only qualified international brands can either be invited to join or can apply through a local digital marketing agency.

JD.com has relatively less market share than Tmall.com, it is also less expensive option. It has a zero tolerance policy for counterfeit products. Same as Tmall, JD.com allows international brands to have individual online stores without being physically presence in China.

Online Wechat store

WeChat is all-in-one-app which integrates social eCommerce seamlessly. Wechat store gives numerous possibilities to International brands to reach Chinese consumers effectively. WeChat Service Account is considered the most suitable for business and organisation that aspires to access to Chinese consumers. Service accounts allow companies to open their own online store. The online store can be used to manage products, take orders, display products, and manage customer complaints.

Related Posts

A New Retail Era Is Coming to China

In an survey conducted by JD.com, about 90% of participants are willing to increase their spending on high-end products by at least 5%, with nearly 60% of them willing to increase their spending by more...

… [Trackback]

[…] There you will find 43209 more Infos: 2open.biz/cross-border-on-chinese-ecommerce-platforms/ […]

I agree with your point of view, your article has given me a lot of help and benefited me a lot. Thanks. Hope you continue to write such excellent articles.

I agree with your point of view, your article has given me a lot of help and benefited me a lot. Thanks. Hope you continue to write such excellent articles.

I read your article carefully, it helped me a lot, I hope to see more related articles in the future. thanks for sharing.

I read your article carefully, it helped me a lot, I hope to see more related articles in the future. thanks for sharing.

Reading your article helped me a lot, but I still had some doubts at the time, could I ask you for advice? Thanks.

Reading your article helped me a lot and I agree with you. But I still have some doubts, can you clarify for me? I’ll keep an eye out for your answers.

Reading your article helped me a lot and I agree with you. But I still have some doubts, can you clarify for me? I’ll keep an eye out for your answers.

Reading your article helped me a lot and I agree with you. But I still have some doubts, can you clarify for me? I’ll keep an eye out for your answers.

For my thesis, I consulted a lot of information, read your article made me feel a lot, benefited me a lot from it, thank you for your help. Thanks!

Very nice post. I just stumbled upon your blog and wanted to say that I’ve really enjoyed browsing your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!

Very nice post. I just stumbled upon your blog and wanted to say that I’ve really enjoyed browsing your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!

Very nice post. I just stumbled upon your blog and wanted to say that I’ve really enjoyed browsing your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!

I have read your article carefully and I agree with you very much. This has provided a great help for my thesis writing, and I will seriously improve it. However, I don’t know much about a certain place. Can you help me?

Reading your article has greatly helped me, and I agree with you. But I still have some questions. Can you help me? I will pay attention to your answer. thank you.

Reading your article has greatly helped me, and I agree with you. But I still have some questions. Can you help me? I will pay attention to your answer. thank you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

I cannot thank you enough for the article.Much thanks again. Much obliged.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

you’re in reality a excellent webmaster. The site loading pace is amazing. It kind of feels that you’re doing any distinctive trick. Moreover, The contents are masterpiece. you’ve done a excellent job in this subject!

canadian pharmacy reviews consumer reports pharmacy com

At the beginning, I was still puzzled. Since I read your article, I have been very impressed. It has provided a lot of innovative ideas for my thesis related to gate.io. Thank u. But I still have some doubts, can you help me? Thanks.

At the beginning, I was still puzzled. Since I read your article, I have been very impressed. It has provided a lot of innovative ideas for my thesis related to gate.io. Thank u. But I still have some doubts, can you help me? Thanks.

At the beginning, I was still puzzled. Since I read your article, I have been very impressed. It has provided a lot of innovative ideas for my thesis related to gate.io. Thank u. But I still have some doubts, can you help me? Thanks.

At the beginning, I was still puzzled. Since I read your article, I have been very impressed. It has provided a lot of innovative ideas for my thesis related to gate.io. Thank u. But I still have some doubts, can you help me? Thanks.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you very much for sharing. Your article was very helpful for me to build a paper on gate.io. After reading your article, I think the idea is very good and the creative techniques are also very innovative. However, I have some different opinions, and I will continue to follow your reply.

I am a website designer. Recently, I am designing a website template about gate.io. The boss’s requirements are very strange, which makes me very difficult. I have consulted many websites, and later I discovered your blog, which is the style I hope to need. thank you very much. Would you allow me to use your blog style as a reference? thank you!

I am a student of BAK College. The recent paper competition gave me a lot of headaches, and I checked a lot of information. Finally, after reading your article, it suddenly dawned on me that I can still have such an idea. grateful. But I still have some questions, hope you can help me.

I may need your help. I tried many ways but couldn’t solve it, but after reading your article, I think you have a way to help me. I’m looking forward for your reply. Thanks.

I may need your help. I tried many ways but couldn’t solve it, but after reading your article, I think you have a way to help me. I’m looking forward for your reply. Thanks.

I may need your help. I tried many ways but couldn’t solve it, but after reading your article, I think you have a way to help me. I’m looking forward for your reply. Thanks.

I may need your help. I tried many ways but couldn’t solve it, but after reading your article, I think you have a way to help me. I’m looking forward for your reply. Thanks.

This article opened my eyes, I can feel your mood, your thoughts, it seems very wonderful. I hope to see more articles like this. thanks for sharing.

Reading your article helped me a lot and I agree with you. But I still have some doubts, can you clarify for me? I’ll keep an eye out for your answers.

Do you mind if I quote a couple of your articles as long asI provide credit and sources back to your website?My blog site is in the very same niche as yours and my users would certainly benefit from some of the information you present here.Please let me know if this okay with you. Thanks!

I love your blog.. very nice colors & theme. Did you design this website yourself or did you hire someone to do it for you? Plz reply as I’m looking to construct my own blog and would like to know where u got this from. thanks a lot

Reading your article has greatly helped me, and I agree with you. But I still have some questions. Can you help me? I will pay attention to your answer. thank you.

Reading your article has greatly helped me, and I agree with you. But I still have some questions. Can you help me? I will pay attention to your answer. thank you.

This article opened my eyes, I can feel your mood, your thoughts, it seems very wonderful. I hope to see more articles like this. thanks for sharing.

Aw, this was a very nice post. In idea I would like to put in writing like this moreover – taking time and precise effort to make an excellent article… but what can I say… I procrastinate alot and in no way seem to get something done.

We’re a group of volunteers and opening a new scheme in our community. Your web site offered us with valuable information to work on. You’ve done an impressive job and our whole community will be grateful to you.

I truly appreciate this blog post.Much thanks again. Keep writing.

Hey, thanks for the blog post.Really thank you! Will read on…

I do enjoy the manner in which you have framed this specific situation and it really does provide me personally a lot of fodder for consideration. On the other hand, coming from everything that I have personally seen, I only wish as the feedback stack on that individuals stay on issue and don’t embark on a soap box regarding some other news of the day. All the same, thank you for this outstanding piece and though I do not really concur with the idea in totality, I respect the perspective.

Yay google is my world beater aided me to find this great website ! .

careprost from india careprost eyelash growth amazon careprost online canada

hi!,I like your writing so much! share we communicate more approximately your article on AOL? I need an expert in this house to resolve my problem. Maybe that is you! Having a look ahead to peer you.

Thanks a lot for the blog post.Really looking forward to read more. Want more.

EN İYİ LEKE KREMİ VE ŞAMPUAN SATIN ALMA SİTESİile hemen tanışın saç dökülme karşıtı şampuanlar sadece 49tlsaç dökülme karşıtı şampuan.

I’m not sure where you’re getting your information, but good topic.I needs to spend some time learning much more or understanding more.Thanks for excellent info I was looking for thisinformation for my mission.

periactin pills for sale order periactin pills online – claritin vs zyrtec

Because the admin of this site is working, no hesitation very shortly it

will be renowned, due to its quality contents.

Enjoyed every bit of your blog post.Really thank you! Will read on…

I think this is a real great article.Really thank you! Fantastic.

#BEOGAMING #BEO777😨#ยุคโควิค การเงิน💸💸ใครมีปัญหา มาทางนี้ 🔜”อยากได้เหมือนเค้า”💢 สนใจแอดไลน์ @BEO777✅ฝาก-ถอน ระบบออโต้✅ชวนเพื่อน รับทันที 0.3 ของยอดฝากเพื่อน ยิ่งชวนมากยิ่งได้มา ตามจำนวนเพื่อนฝูง✅lว็บตรงไม่ผ่านเอเย่นต์ มั่นคง100✨

big pharmacy online canada pharmacy safedrg – the canadian pharmacy

A round of applause for your article post.Thanks Again. Really Great.

Thanks so much for the post.Much thanks again. Really Great.

all the time i used to read smaller articles or reviews which as well clear their motive, and that isalso happening with this piece of writing which I am reading now.

Thanks for sharing, this is a fantastic post.Really thank you! Fantastic.

Really enjoyed this blog post.Really looking forward to read more. Cool.

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time acomment is added I get four emails with the same comment.Is there any way you can remove people from that service?Bless you!

Thanks a lot for the blog post. Much obliged.

I read this post fully regarding the resemblance of hottestand earlier technologies, it’s awesome article.

causes for ed ed medication online – ed in men

Well I really enjoyed reading it. This article offered by you is very effective for proper planning.

Bardzo interesujące informacje! Idealnie to, czego szukałem! aparat tlenowy.

I like the helpful information you provide in your articles.I will bookmark your blog and check again here regularly.I’m quite certain I will learn plenty of new stuff right here!Best of luck for the next!

Very neat article.Thanks Again. Want more.

YouTube to MP3 converters are important. wanna get one? Click on my name for more.

Heya i am for the first time here. I found thisboard and I find It truly useful & it helped me out a lot.I hope to give something back and aid others like you helped me.

This information iss worth everyone’s attention. When can Ifind out more?

If you’re currently a drinker, be bound to stop drinking altogether perhaps. Talk to your doctor and discuss your problem to know which medicine is most suited to you. Do you know what erectile dysfunction is?

My brother suggested I would possibly like this blog. He was totally right. This post truly made my day. You cann’t believe simply how so much time I had spent for this information! Thanks!

I am 38 year old female Just saying thanks!

advantages over the other and and friends of their friends

3 tages antibiotikum azithromycin – z pack over the counter z pack for tooth infection

Team monitoring tools. Event managementdevices.Feel free to surf to my blog post nonprofit software companies

I constantly spent my half an hour to read this blog’s articlesor reviews daily along with a cup of coffee.

Aw, this was an extremely good post. Taking a few minutes and actual effort to produce a top notch article… but what can I say… I hesitate a whole lot and don’t manage to get nearly anything done.

Hello my loved one! I wish to say that this post is awesome, great written and include approximately all significant infos. I’d like to see more posts like this .

Hello there! Do you know if they make any plugins to assist with Search Engine Optimization? I’m tryingto get my blog to rank for some targeted keywords but I’m not seeing verygood gains. If you know of any please share. Kudos!

eu pharmacy online antibiotics online pharmacy

There is certainly a great deal to find out aboutthis topic. I really like all the points you have made.

Great blog you have here.. It’s difficult to find qualitywriting like yours nowadays. I seriously appreciate peoplelike you! Take care!!

Cwraui – furosemidelasixx.com Cfaqba dolcuv

This discovery could explain the difference between thin people, who can eat anything without gaining a gram, and others who gain weight from the smallest food particles

Major thankies for the article.Really thank you! Great.

Sweet blog! I found it while searching on YahooNews. Do you have any tips on how to get listed in Yahoo News?I’ve been trying for a while but I neverseem to get there! Thanks

rx solutions pharmacy online pharmacy store in kolkata

These are truly enormous ideas in concerning blogging.You have touched some fastidious factors here. Any way keep up wrinting.

zithromax without a script – zithrognr.com zithromax antibiotic zithromax

I will right away snatch your rss feed as I can not to find your e-mail subscription hyperlink or newsletter service. Do you’ve any? Please allow me recognize in order that I may subscribe. Thanks.

Greetings! Very helpful advice in this particular article! It is the little changes that produce the most significant changes. Thanks a lot for sharing!

That is a very good tip particularly to those freshto the blogosphere. Simple but very accurate information… Thanks for sharingthis one. A must read article!

I am not sure where you are getting your information, but great topic. I needs to spend some time learning more or understanding more. Thanks for fantastic information I was looking for this info for my mission.

excellent issues altogether, you just gained a brand new reader.What would you suggest in regards to your post that you made a few days ago?Any certain?

Oh my goodness! a tremendous article dude. Thank you Nevertheless I’m experiencing difficulty with ur rss . Don’t know why Unable to subscribe to it. Is there anyone getting similar rss problem? Anyone who is aware of kindly respond. Thnkx

Howdy! I’m at work browsing your blog from my new iphone! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the superb work!

Your style is unique compared to other people I have read stuff from. I appreciate you for posting when you have the opportunity, Guess I’ll just book mark this blog.

4 corners pharmacy supreme suppliers onlinepharmacy

There’s definately a lot to learn about this issue. I love all ofthe points you have made.

I love the efforts you have put in this, thankyou for all the great blog posts.

Thanks for sharing, this is a fantastic blog article. Great.

Im grateful for the post.Much thanks again. Will read on…

Appreciate you sharing, great blog. Much obliged.

Great article post.Really thank you! Really Great.

מעסה יפהפיה חדשה בתל אביב נמצאת ליד עזריאלי מחכה לכם עכשיו באווירה נעימה ודיסקרטית לעיסוי חושני ומפנק! חוויה שאסור לפספס!מעסות פצצות על מארחות אותך בדירה מפוארת ברמת גן. מאוד צעירות לפינוק מושלם דירות דיסקרטיות בבת ים

Aw, this was a really good post. Taking a few minutes and actual effort to produce a superb articleÖ but what can I sayÖ I put things off a whole lot and don’t seem to get anything done.

Do you have a spam issue on this blog; I also am a blogger, and I was curious about your situation; we have developed some nice procedures and we are looking to swap techniques with others, please shoot me an e-mail if interested.

When I originally commented I clicked the “Notify me when new comments are added” checkboxand now each time a comment is added I get four emails with the same comment.Is there any way you can remove people from that service?Thanks!

At this time it sounds like WordPress is the preferred blogging platform out there right now. (from what I’ve read) Is that what you’re using on your blog?

A blog like yours should be earning much money from adsense..-.,”agen idn poker

Major thankies for the article.Really thank you! Want more.

Aw, this was a really nice post. Finding the time and actual effort to produce a very good articleÖ but what can I sayÖ I procrastinate a whole lot and never manage to get nearly anything done.

Thank you ever so for you blog.Thanks Again. Will read on…

Hello, the whole thing is going fine here and ofcourse every one is sharing information, that’s actually fine, keep up writing.

Really enjoyed this blog post.Really thank you! Awesome.

ed remedies: ed pills for sale – ed remedies

Amazing. Master. You’re the guru. Give thanks you.

Thank you ever so for you blog article.Thanks Again. Want more.

Hey, thanks for the blog article.Really thank you! Cool.

Very informative article.Really looking forward to read more. Much obliged.

Very good article post.Much thanks again. Cool.

I really enjoy the blog.Really thank you! Much obliged.

An interesting discussion is worth comment. There’s no doubt that that you ought to publish more on this topic, it might not be a taboo subject but usually folks don’t discuss such issues. To the next! Many thanks!!

• A Fort Myers man won a $1 million prize in the $five,000,000 GoldRush Doubler scratch-off game.

Hello, I enjoy reading all of your article post. I like to write a little comment to supportyou.

This is my first time visit at here and i am actually impressed to read all at one place.

I am so grateful for your article.Really looking forward to read more. Want more.

I’m not sure where you’re getting your information, but good topic.I needs to spend some time learning more or understanding more.Thanks for fantastic info I was looking for thisinfo for my mission.

I truly appreciate this blog.Really thank you! Much obliged.

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.

An interesting discussion is definitely worth comment. I believe that you ought to write more about this subject, it may not be a taboo subject but generally folks don’t speak about such issues. To the next! All the best!

Really informative blog post.Much thanks again. Much obliged.

Great blog you’ve got here.. Itís difficult to find quality writing like yours these days. I truly appreciate people like you! Take care!!

Locksmith, highly recommend Locksmith SOUTH WEST LONDON

Excellent blog you have here.. Itís difficult to find quality writing like yours these days. I truly appreciate individuals like you! Take care!!

Very informative blog post.Thanks Again. Much obliged.Loading…

Thanks for another fantastic post. Where else could anyone get that kind of information in such an ideal way of writing? I have a presentation next week, and I am on the look for such information.

chloroquine diphosphate does hydroxychloroquine work

Looking forward to reading more. Great blog article.Really looking forward to read more. Really Great.

Hey, thanks for the blog article. Much obliged.

I loved your blog article.Thanks Again. Great.

Major thankies for the blog article.Much thanks again.

I am not very great with English but I find this really leisurely to interpret.Have a look at my blog post; holiday weight loss

homework help onlineessay writing service review

I’m not sure where you’re getting your info, but great topic.I needs to spend some time learning more or understanding more.Thanks for great info I was looking for this info for mymission.

custom coursework writing coursework papers

You can definitely see your enthusiasm within the work you write.The world hopes for more passionate writers like you who aren’t afraid to sayhow they believe. All the time follow your heart.Here is my blog :: Nina

continuously i used to read smaller posts which as wellclear their motive, and that is also happening with this post which I am reading at this place.

online doctor to prescribe hydroxychloroquine what are the side effects of hydroxychloroquine

For a moment, Ms. Yuni took a breath. Then he asked me to turn around and immediately climbed into my lap. I put my erect penis into his heavenly hole.

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.

There’s certainly a great deal to find out about this topic. I love all of the points you’ve made.

Great, thanks for sharing this article.Thanks Again. Will read on…

Enjoyed every bit of your blog article. Want more.

Thanks so much for the article. Want more.

Fantastic blog.Much thanks again. Really Great.

I really like reading an article that will make people think. Also, many thanks for allowing me to comment.

Say, you got a nice post. Really Cool.

wow, awesome article.Really thank you! Really Cool.

I will right away grab your rss as I can not find your email subscription link or newsletter service. Do you’ve any? Please let me know in order that I could subscribe. Thanks.

Really appreciate you sharing this blog.Much thanks again. Really Great.

I am continually looking online for ideas that can benefit me. Thanks!

Thanks-a-mundo for the article.Thanks Again.

I appreciate you sharing this blog article.Much thanks again. Will read on…

Enjoyed every bit of your article post.Much thanks again. Fantastic.

A round of applause for your blog article.Thanks Again. Awesome.

Im obliged for the post.Thanks Again. Really Great.

I truly appreciate this article. Awesome.

Thanks-a-mundo for the blog post.Much thanks again.

I cannot thank you enough for the post.Really looking forward to read more. Awesome.

Wow! This blog looks just like my old one! It as on a completely different topic but it has pretty much the same layout and design. Outstanding choice of colors!

Hey, thanks for the article post.Thanks Again.

I do agree with all the ideas you’ve presented in your post. They’re really convincing and will certainly work. Still, the posts are very short for novices. Could you please extend them a little from next time? Thanks for the post.

Can someone recommend Fun and Games? Cheers xx

I cannot thank you enough for the blog.Really looking forward to read more. Really Great.

canadian pharmacy no scripts real canadian pharmacy my canadian pharmacy review Kbhhol aqkkml

Custom essays writers services us studybayUYhjhgTDkJHVy

Locksmith, highly recommend Locksmith Kensington SW5

There is definately a lot to find out about this subject.I like all of the points you made.

bluecross health insurance paulding county health departmentivermectin btgjbe

Great article and straight to the point. I am not sure if this is truly the best place to ask but do you folks have any ideea where to get some professional writers? Thx 🙂

I really like what you guys are up too. This sort of cleverwork and exposure! Keep up the excellentworks guys I’ve added you guys to my blogroll.

wow, awesome article. Keep writing.

Aw, this was a very nice post. Taking the time and actual effort to create a very good article… but what can I say… I put things off a whole lot and don’t manage to get anything done.

wow, awesome blog post.Really looking forward to read more.

I loved your post. Want more.

Wow, great blog post. Will read on…

Real nice style and superb articles , absolutely nothing else we want : D.

I’m not sure where you’re getting your info, butgood topic. I needs to spend some time learning more or understanding more.Thanks for wonderful information I was looking for this info for my mission.

I’m not sure where you’re getting your information, but great topic. I needs to spend some time learning much more or understanding more. Thanks for fantastic information I was looking for this information for my mission.

Really appreciate you sharing this post. Really Cool.

natural remedies for ed problems trusted india online pharmacies – best canadian pharmacy online

I will immediately grab your rss as I can’t tofind your email subscription link or newsletter service. Do you’ve any?Please allow me recognize so that I may just subscribe.Thanks.

I enjoy reading an article that can make men andwomen think. Also, thanks for permitting me to comment!

Great post. I was checking continuously this blog and Iam impressed! Extremely useful information particularly the last part 🙂 Icare for such information much. I was seeking this particular infofor a very long time. Thank you and good luck.

Sounds like anything plenty of forty somethings and beyond ought to study. The feelings of neglect is there in a lot of levels every time a single ends the mountain.

Thanks. I like this. online pharmacies canada

Hello my family member! I wish to say thzt this article is amazing,great written and include almost all vital infos.I’d like to see more posts like this .

I really like looking through a post that can make men and women think. Also, thanks for allowing me to comment!

What do you study? xantrin Under SolarWorld’s debt restructuring deal, Qatar Solar willinvest 35 million euros in SolarWorld, becoming a 29-percentshareholder in the group, while existing shareholders will endup with 5 percent.

Muchos Gracias for your blog.Thanks Again. Fantastic.

I really enjoy the blog.Thanks Again. Cool.

Really informative blog post.Much thanks again. Want more.

Hello my friend! I wish to say that this article is amazing, nice written and come with almost all significant infos. I would like to look extra posts like this .

CBbJTlMKhclNDaIp

erectile dysfunction doctors near me – erectile dysfunction pills new treatments for ed

There’s certainly a great deal to learn about this issue. I love all of the points you have made.

Hello! I know this is kind of off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

Delta really has changed the course of the pandemic. It is far more contagious than earlier versions of the virus and calls for precautions that were not necessary a couple of months ago, like wearing masks in some indoor situations.인터넷카지노

Highly energetic article, I enjoyed that bit. Will there be apart 2?

Really enjoyed this post.Really looking forward to read more.

I read this post completely concerning the comparison of hottest and previous technologies, it’s awesome article.

There is certainly a great deal to find out about this issue. I really like all of the points you made.

sxuKDtcTkHhlIMFAEJmkaqd

Awesome blog post.Thanks Again. Will read on…

I appreciate you sharing this blog.Thanks Again. Want more.

anyone know of a legit online pharmacy for oxycodone canadian pharmacy reviews consumer reports

Wonderful blog! I found it while searching on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Thanks

I read this article completely on the topic of the comparison of newest and preceding technologies, it’s amazing article.

Very neat article.Much thanks again. Will read on…

I like forgathering utile info, this post has got me even more info! .

Actually no matter if someone doesn’t know afterward its up to otherpeople that they will help, so here it happens.

Thanks a lot for the post.Thanks Again. Really Cool.

Hi. Interesting material! I’m really enjoy this. It will be great if you’ll read my first article on AP!)Loading…

Very good blog.Thanks Again. Keep writing.

You could certainly see your expertise in the work you write. The world hopes for more passionate writers like you who aren’t afraid to say how they believe. Always go after your heart.

Really informative post.Much thanks again. Cool.

Really informative article post.Much thanks again. Keep writing.

Hey there! This post couldn’t be written any better! Reading this post reminds me ofmy old room mate! He always kept chatting about this.I will forward this article to him. Fairly certain he will havea good read. Thank you for sharing!

Yay google is my world beater helped me to find this great web site ! .

I loved your article.Really thank you! Awesome.

Thanks for sharing, this is a fantastic blog article.

A fascinating discussion is definitely worth comment. There’s no doubt that that you need to write more on this issue, it might not be a taboo matter but generally folks don’t speak about these issues. To the next! Best wishes!!

I’d like to speak to someone about a mortgage bone pain from dilantin and tegretol this is a little boy with his dog who is doing nothing wrong And Sarah I enjoy your quote for the new year” commented Linda Conley Eltzroth Darling.

Amazon accounts for sale[…]always a major fan of linking to bloggers that I appreciate but dont get a great deal of link appreciate from[…]

Hey, thanks for the blog post.Really looking forward to read more. Really Cool.

I think this is a real great article post. Much obliged.

Wow, great post.Much thanks again. Really Cool.Loading…

Thanks so much for the blog post.Thanks Again. Will read on…

I am now not sure the place you are getting your information, but goodtopic. I must spend some time finding out more or working out more.Thank you for fantastic information I used to belooking for this info for my mission.

Great, thanks for sharing this blog article. Awesome.

Muchos Gracias for your article.Much thanks again. Will read on…

Very interesting details you have noted , thanks for putting up. “The only thing worse than a man you can’t control is a man you can.” by Margo Kaufman.

This is one awesome post. Keep writing.

Appreciate you sharing, great blog.

Major thanks for the article post.Much thanks again. Great.

I am so grateful for your blog post. Really Cool.

I don’t even understand how I stopped up here, however I thought this submit used to be good. I don’t understand who you might be however definitely you are going to a well-known blogger if you happen to aren’t already 😉 Cheers!

It’s in point of fact a great and helpful piece of info.I’m happy that you just shared this useful information with us.Please keep us informed like this. Thank you for sharing.

These are actually great ideas in regarding blogging.You have touched some nice things here. Any way keep up wrinting.

Hello there! Do you know if they make any plugins toprotect against hackers? I’m kinda paranoidabout losing everything I’ve worked hard on. Any tips?

I truly appreciate this blog article.Thanks Again. Great.

Really enjoyed this blog article.Really looking forward to read more. Fantastic.

Very good article post.Thanks Again. Want more.

I really liked your blog article. Really Great.

Wow that was strange. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyhow, just wanted to say great blog!

Greetings! Very helpful advice within this article! It’s the little changes that make the greatest changes. Many thanks for sharing!

I needed to thank you for this wonderful read!! I certainly loved every bit of it. I have got you book-marked to look at new stuff you postÖ

I love the theatre is flonase safe pregnancy Train passengers and railway staff push a train car to rescue a woman who fell and got stuck between the car and the platform while getting off at Japan Railway Minami Urawa Station near Tokyo, Monday.

Aw, this was an incredibly nice post. Finding the time and actual effort to generate a top notch articleÖ but what can I sayÖ I hesitate a whole lot and never seem to get anything done.

careprost lash careprost eyelash growth reviews careprost vs bimat

Highly descriptive blog, I loved that bit.Will there be a part 2?

canadian family pharmacy canada online pharmacies canada pharmacies online

dissertation statistics dissertation writing fellowships dissertation services

Great post.Really looking forward to read more. Much obliged.

Hello, you used to write great, but the last several posts have been kinda boring?I miss your tremendous writings. Past several posts are just a littlebit out of track! come on!my blog; kebe.top

Awesome post.Really looking forward to read more. Really Great.

Thank you for your article.Really looking forward to read more. Keep writing.Loading…

I value the article.Thanks Again. Keep writing.

You ought to take part in a contest for one of the finest blogs on the net. bandar togel bayaran besar I am going to highly recommend this blog

Hi there friends, how is all, and what you would like to say on the topic of this article, in myview its in fact amazing in favor of me.

Muchos Gracias for your blog. Awesome.

and we can assure you they are 8free PSN codes.

I quite like reading through a post that will make men and women think.Also, thank you for permitting me to comment!

I like looking through an article that will make people think. Also, many thanks for permitting me to comment!

Awsome article burn fat and build muscle rightto the point. I don’t know if this is really the best place to ask but do you folks have any ideea where to employ some professional writers?Thank you 🙂

Looking forward to reading more. Great blog post.Really looking forward to read more. Awesome.

My brother suggested I might like this blog.He was entirely right. This post actually made my day. You can not imagine just how much time Ihad spent for this information! Thanks!My blog: Live Well CBD Review

Really appreciate you sharing this blog post.Thanks Again. Will read on…

Fantastic article.Much thanks again. Want more.

Thanks for some other great article. Where else may anyone get that type of information in such a perfect method of writing? I have a presentation next week, and I am on the look for such information.

Great awesome issues here. I am very satisfied to peer your article. Thank you a lot and i’m taking a look forward to contact you. Will you please drop me a e-mail?

Aşık Etme Duası says:At this time it appears like BlogEngine is the top blogging platform available right now. (from what I’ve read) Is that what you’re using on your blog?????????????????Reply 11/20/2021 at 8:10 am

Fantastic blog post. Fantastic.

Thank you for your blog article.Thanks Again. Awesome.

I am so grateful for your blog post.Thanks Again. Great.

Greetings! Very useful advice in this particular article! It is the little changes that will make the largest changes. Thanks a lot for sharing!

I really enjoy the article post.Really looking forward to read more. Keep writing.

Pretty great post. I simply stumbled upon your blogand wanted to say that I have really enjoyed surfingaround your blog posts. In any case I will be subscribingon your rss feed and I hope you write again soon!

liquid ivermectin where can i get ivermectin

Enjoyed examining this, very good stuff, regards . “I will do my best. That is all I can do. I ask for your help-and God’s.” by Lyndon B. Johnson. Maryanne Tanner Kynthia

I like the valuable info you provide in your articles. I will bookmark your blog and check again here frequently. I am quite sure I’ll learn plenty of new stuff right here! Best of luck for the next!

Very nice post. I just stumbled upon your blog and wished to say that I’ve truly enjoyed browsing your blog posts. After all I will be subscribing to your rss feed and I hope you write again very soon!

ivermectin for sale stromectol oral – ivermectin usa

Thanks-a-mundo for the blog article.Thanks Again. Fantastic.

Thanks, I have recently been searching for information about this subject for ages and yours is the greatest I’ve discovered so far. However, what concerning the conclusion? Are you positive about the source?

Hi there, just became aware of your blog through Google, and found that itis truly informative. I’m gonna watch out for brussels.I’ll appreciate if you continue this in future. Lots of people willbe benefited from your writing. Cheers!

That is a very good tip particularly to those new to the blogosphere. Short but very accurate infoÖ Appreciate your sharing this one. A must read article!

ivermectin eczema ivermectin paste for cattle

It is really a nice and useful piece of info. I’m glad that you simply shared this useful information with us. Please stay us up to date like this. Thanks for sharing.

RiMSFPEMNrPJRujTcI

SlbjzapyPJCWyVuPCI

You can certainly see your enthusiasm in the article you write. The arena hopes for even more passionate writers such as you who are not afraid to mention how they believe. All the time go after your heart.

I think this is a real great post.Thanks Again. Cool.

wow, awesome article.Really looking forward to read more. Much obliged.

I enjoy looking through an article that will make people think.Also, many thanks for allowing for me to comment!

I think this is a real great blog article.Much thanks again. Great.

Hi would you mind letting me know which hosting company you’re utilizing? I’ve loaded your blog in 3 completely different web browsers and I must say this blog loads a lot quicker then most. Can you recommend a good hosting provider at a reasonable price? Cheers, I appreciate it!

Awesome issues here. I am very happy to look your post.Thank you a lot and I am looking forward to touch you.Will you please drop me a mail?

What’s Happening i am new to this, I stumbled upon this I’ve found It absolutely useful and it has aided me out loads. I hope to contribute & aid other users like its aided me. Great job.

we have same blog where you can post comment

Hi! I just wanted to ask if you ever have any problems with hackers?My last blog (wordpress) was hacked and I ended up losing many months ofhard work due to no backup. Do you have any methods to stop hackers?

Really enjoyed this article post.Much thanks again. Want more.

essay rewriter essay assistance argumentative essays

pre written essays for sale – online assignment help edit letter

Thanks for another fantastic post. Where else could anybody get that type of information in such a perfect way of writing? I’ve a presentation next week, and I’m on the look for such info.

best ed pills online – how to fix ed erection pills

Hey! Would you mind if I share your blog with my twitter group?There’s a lot of folks that I think would really appreciate yourcontent. Please let me know. Thanks

Well I definitely liked reading it. This tip provided by you is very constructive for proper planning.

I cannot thank you enough for the post.Really thank you! Really Great.

Gst Billing software says:Keep functioning ,terrific job!Reply 05/18/2020 at 8:50 am

Thanks for sharing such a nice opinion, piece of writing is fastidious, thats why i have readit completelyFeel free to visit my blog post – Parking Devices

Muchos Gracias for your post.Really thank you!

Very good article.Really looking forward to read more. Much obliged.

I blog quite often and I seriously appreciate your information. This article has truly peaked my interest. I am going to take a note of your blog and keep checking for new details about once a week. I subscribed to your Feed as well.

Thanks so much for the blog post.Thanks Again. Awesome.

vwFSSxSJzmwYrEfUoynLFot

Thanks so much for the blog post.Really looking forward to read more. Will read on…

I am so grateful for your article.Really thank you! Cool.

Dihydrofolate reductase sulfamethoxazole tmp ds

What an incredible manner of taking a look at things.

When I originally commented I clicked the «Notify me when new comments are added» checkbox andnow each time a comment is added I get three e-mails with the same comment.Is there any way you can remove people from that service?Thank you!

I truly appreciate this article.Really looking forward to read more. Great.

as it ensures premium security and gratitude to the basic enlistment process you won’t pass up the lates squid games online in many shapes and motors!

Hi there, this weekend is pleasant in support of me, because thistime i am reading this fantastic educational paragraph here at my residence.

This is one awesome post.Really looking forward to read more. Cool.

Hi, I do think this is a great blog. I stumbledupon it 😉 I am going to come back once again since i have book marked it. Money and freedom is the greatest way to change, may you be rich and continue to help other people.

win79

Major thankies for the article.Really thank you!

Hello i am kavin, its my first occasion to commenting anywhere, when i readthis article i thought i could also make comment due to this brilliant article.

You completed certain fine points there. I did a search on the matter and found the majority of folks will agree with your blog.

Really enjoyed this blog article.Thanks Again. Will read on…

Thank you for the good writeup. It in truth was once a amusement account it. Look complex to more brought agreeable from you! However, how could we keep up a correspondence?

I really liked your article post.Really thank you! Want more.

Bedava hesap, para vermeden ücretsiz bir şekilde biruygulama, oyun, hesap, program vb.. gibi ücretli yada ücretsiz şekilde alınabilen bir bağlantı aracıdır.Bedava hesap

Hello there! I could have sworn I’ve been to this blog before but after reading through some ofthe post I realized it’s new to me. Anyways, I’m definitelyglad I found it and I’ll be book-marking and checking back frequently!

amlodipine besylate benazepril hydrochloride norvasc blood pressure med

Highly energetic blog, I enjoyed that bit.Will there be a part 2?

Great blog article.Really looking forward to read more. Awesome.

whoah this blog is wonderful i like studying your articles.Stay up the good work! You know, many persons arelooking round for this information, you could aid them greatly.

VPS SERVER

Высокоскоростной доступ в Интернет: до 1000 Мбит/с

Скорость подключения к Интернету — еще один важный фактор для успеха вашего проекта. Наши VPS/VDS-серверы, адаптированные как под Windows, так и под Linux, обеспечивают доступ в Интернет со скоростью до 1000 Мбит/с, что гарантирует быструю загрузку веб-страниц и высокую производительность онлайн-приложений на обеих операционных системах.

Thank you for another excellent article. Where else could anybody get that type of info in such a perfect means of writing? I have a presentation next week, and I am at the search for such information.

Heya i’m for the primary time here. I found this board and I to find It truly useful & it helped me out much.I’m hoping to give something again and help others such as you aided me.

I really liked your blog post.Much thanks again. Great.

974057 160045A great deal of writers recommend just writing and composing no matter how bad and if the story is going to develop, youll suddenly hit the zone and itll develop. 972682

Thanks for sharing your thoughts about idnpoker. Regards

Thanks for sharing, this is a fantastic blog.Much thanks again. Great.

Hi! This is my first visit to your blog! We are a group of volunteers and starting anew initiative in a community in the same niche. Your blog providedus beneficial information to work on. You havedone a marvellous job!

I appreciate you sharing this article.Really thank you! Will read on…

That is a very good tip especially to those fresh to the blogosphere.Short but very precise info… Thanks for sharing this one.A must read post!

For the sake of getting broad, We’ll take into account 6 strategies aboutFree Gmail Accounts 2021 Google Mail Account idAnd Passwordfree gmail account

hEUWHKWCRmLChxAcvAP

It’s in fact very complex in this busy life to listen news on TV,so I only use internet for that reason, and takethe most up-to-date information.

Really enjoyed this blog article.Really thank you! Keep writing.

Fantastic blog post.Much thanks again. Fantastic.

Looking forward to reading more. Great blog article.Much thanks again. Cool.

I really like and appreciate your blog.Really looking forward to read more. Great.

Wow. Wizard. You’re a wizard. Give thanks to you.

Good way of telling, and fastidious paragraph to get information on thetopic of my presentation subject matter, which i am going to convey in academy.

Say, you got a nice blog article.Thanks Again. Awesome.

Grady Thompson

It’s hard to come by experienced people about this topic, but you soundlike you know what you’re talking about! Thanks

Muchos Gracias for your post.Much thanks again. Really Cool.

Rattling informative and good complex body part of content material, now that’s user genial (:.

Outstanding post but I was wanting to know if you could write alitte more on this subject? I’d be very thankful if you could elaborate a little bit further.Bless you!

Thanks for the article post.Really looking forward to read more. Cool.

Really enjoyed this article post. Fantastic.

Enjoyed every bit of your post.Much thanks again. Much obliged.

An interesting discussion is worth comment.I do think that you ought to write more on this subject, itmight not be a taboo subject but typically people do not discusssuch issues. To the next! Best wishes!!

over the counter erectile dysfunction pills ed treatment reviewed pills for sale

Wow! This could be one particular of the most helpful blogs We’ve ever arrive across on this subject. Actually Great. I am also an expert in this topic so I can understand your effort.

Major thanks for the blog article.Thanks Again.

chloroquine prophylaxis chloroquine quinine hydroxychloroquine side effects heart

Thanks for the article.Thanks Again. Fantastic.

hydroxycloro quineprox kratom chloroquine hydroxychloroquine sulfate tablets

Your style is unique compared to other folks I have read stufffrom. Thanks for posting when you have the opportunity, Guess I will just bookmark this blog.

Heya! I’m at work surfing around your blog from my new iphone! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the excellent work!

An interesting discussion is worth comment. I feel that you must write more on this matter, it may not be a taboo subject however typically individuals are not sufficient to speak on such topics. To the next. Cheers

Looking forward to reading more. Great blog post.Really looking forward to read more. Awesome.

I really enjoy the blog article.Much thanks again. Want more.

Birbirinden güzel ve cazibeli ankara eskort modelleri tpolice.com da.

Now I am going away to do my breakfast, when having my breakfast coming yetagain to read other news.

of course like your website however you need to test the spelling on several of your posts. Many of them are rife with spelling problems and I to find it very bothersome to tell the reality then again I?ll certainly come again again.

I’m no longer certain where you are getting your information, however great topic. I must spend a while studying more or figuring out more. Thank you for magnificent info I was on the lookout for this information for my mission.

Im grateful for the blog article.Much thanks again. Fantastic.

I really enjoy the post.Really thank you! Much obliged.

Read classical short stories. click on my name to read.

Thanks a lot for the blog.Really looking forward to read more. Awesome.

I think this is a real great blog.Thanks Again. Great.

I do believe all the ideas you have presented to your post.They’re really convincing and can definitely work.Nonetheless, the posts are too short for starters. May you please extend them a bit fromsubsequent time? Thanks for the post.

vantin generic: order ceftin onlineminocycline generic

Really enjoyed this post.Really thank you! Really Cool.

Mae Curtis

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

Amazing issues here. I am very satisfied to peer your article. Thanks so much and I am taking a look ahead to contact you. Will you kindly drop me a mail?

Really appreciate you sharing this blog post.Really thank you! Will read on…

I’ll right away seize your rss as I can not find your emailsubscription link or newsletter service. Do you haveany? Please let me understand in order that I could subscribe.Thanks.

continuously i used to read smaller articles or reviews which aswell clear their motive, and that is also happening with this articlewhich I am reading at this time.Here is my blog – 우리카지노

Hi there, yup this piece of writing is actually fastidious and I have learned lot of things fromit regarding blogging. thanks.

Im grateful for the blog article.Thanks Again. Awesome.

Enjoyed every bit of your post.Thanks Again. Keep writing.

Hailey Mathews

Thanks so much for the post.Really thank you! Really Cool.

I’m in awe of the author’s capability to make complex concepts understandable to readers of all backgrounds. This article is a testament to his expertise and passion to providing useful insights. Thank you, author, for creating such an compelling and insightful piece. It has been an incredible joy to read!

I cannot thank you enough for the article post.Thanks Again. Really Great.

Muchos Gracias for your post.Really looking forward to read more. Great.

Thank you for your post.Really looking forward to read more. Will read on…

Tiêu đề: “B52 Club – Trải nghiệm Game Đánh Bài Trực Tuyến Tuyệt Vời”

B52 Club là một cổng game phổ biến trong cộng đồng trực tuyến, đưa người chơi vào thế giới hấp dẫn với nhiều yếu tố quan trọng đã giúp trò chơi trở nên nổi tiếng và thu hút đông đảo người tham gia.

1. Bảo mật và An toàn

B52 Club đặt sự bảo mật và an toàn lên hàng đầu. Trang web đảm bảo bảo vệ thông tin người dùng, tiền tệ và dữ liệu cá nhân bằng cách sử dụng biện pháp bảo mật mạnh mẽ. Chứng chỉ SSL đảm bảo việc mã hóa thông tin, cùng với việc được cấp phép bởi các tổ chức uy tín, tạo nên một môi trường chơi game đáng tin cậy.

2. Đa dạng về Trò chơi

B52 Play nổi tiếng với sự đa dạng trong danh mục trò chơi. Người chơi có thể thưởng thức nhiều trò chơi đánh bài phổ biến như baccarat, blackjack, poker, và nhiều trò chơi đánh bài cá nhân khác. Điều này tạo ra sự đa dạng và hứng thú cho mọi người chơi.

3. Hỗ trợ Khách hàng Chuyên Nghiệp

B52 Club tự hào với đội ngũ hỗ trợ khách hàng chuyên nghiệp, tận tâm và hiệu quả. Người chơi có thể liên hệ thông qua các kênh như chat trực tuyến, email, điện thoại, hoặc mạng xã hội. Vấn đề kỹ thuật, tài khoản hay bất kỳ thắc mắc nào đều được giải quyết nhanh chóng.

4. Phương Thức Thanh Toán An Toàn

B52 Club cung cấp nhiều phương thức thanh toán để đảm bảo người chơi có thể dễ dàng nạp và rút tiền một cách an toàn và thuận tiện. Quy trình thanh toán được thiết kế để mang lại trải nghiệm đơn giản và hiệu quả cho người chơi.

5. Chính Sách Thưởng và Ưu Đãi Hấp Dẫn

Khi đánh giá một cổng game B52, chính sách thưởng và ưu đãi luôn được chú ý. B52 Club không chỉ mang đến những chính sách thưởng hấp dẫn mà còn cam kết đối xử công bằng và minh bạch đối với người chơi. Điều này giúp thu hút và giữ chân người chơi trên thương trường game đánh bài trực tuyến.

Hướng Dẫn Tải và Cài Đặt

Để tham gia vào B52 Club, người chơi có thể tải file APK cho hệ điều hành Android hoặc iOS theo hướng dẫn chi tiết trên trang web. Quy trình đơn giản và thuận tiện giúp người chơi nhanh chóng trải nghiệm trò chơi.

Với những ưu điểm vượt trội như vậy, B52 Club không chỉ là nơi giải trí tuyệt vời mà còn là điểm đến lý tưởng cho những người yêu thích thách thức và may mắn.

Whats up this is kinda of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding skills so I wanted to get advice from someone with experience. Any help would be greatly appreciated!

I used to be very happy to seek out this internet-site.I wanted to thanks for your time for this glorious read!! I positively having fun with each little bit of it and I’ve you bookmarked to take a look at new stuff you weblog post.

I have been exploring for a bit for any high quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this site. Reading this information So i am happy to convey that I have a very good uncanny feeling I discovered just what I needed. I most certainly will make certain to do not forget this site and give it a look regularly.

Hi, I do think this is an excellent blog. I stumbledupon it 😉 I will return once again since I saved as a favorite it. Money and freedom is the best way to change, may you be rich and continue to help others.

Thanks for your marvelous posting! I genuinely enjoyed reading it,you are a great author.I will always bookmark yourblog and will eventually come back sometime soon.I want to encourage that you continue your great job, have a nice weekend!

I have really learned new things through your web site. One other thing I’d prefer to say is that newer personal computer operating systems are likely to allow much more memory to be used, but they likewise demand more storage simply to operate. If an individual’s computer can not handle much more memory along with the newest computer software requires that memory increase, it can be the time to buy a new Laptop or computer. Thanks

There is evidently a lot to identify about this. I assume you made some good points in features also.

ivermectin for horses safe for humans stromectol canada

Muchos Gracias for your blog article.Really looking forward to read more. Much obliged.

Superb material. Cheers. canada pharmaceutical online ordering

Thank you for your blog.Really thank you! Will read on…

You can certainly see your expertise in the work you write. The sector hopes for even more passionate writers such as you who are not afraid to say how they believe. All the time follow your heart.

hey there and thanks to your information ? I have definitely picked up something new from right here. I did on the other hand expertise some technical issues using this site, since I skilled to reload the web site lots of occasions previous to I may get it to load correctly. I had been pondering if your web host is OK? Not that I’m complaining, but slow loading cases times will very frequently impact your placement in google and can harm your high quality rating if ads and ***********|advertising|advertising|advertising and *********** with Adwords. Well I?m adding this RSS to my email and can look out for a lot extra of your respective fascinating content. Make sure you replace this again very soon..

What’s up, I read your blog regularly. Your writing styleis witty, keep it up!

A round of applause for your blog post.Really thank you! Cool.

Hello! I could have sworn Iíve been to your blog before but after going through many of the posts I realized itís new to me. Anyways, Iím definitely pleased I discovered it and Iíll be bookmarking it and checking back frequently!

Everyone loves what you guys tend to be up too. This type ofclever work and coverage! Keep up the superb works guys I’ve incorporated youguys to my own blogroll.

I like looking through a post that will make people think. Also, many thanks for allowing me to comment!

Really enjoyed this article.

Awesome! Its truly amazing post, I have got much clear idea on the topic of from this piece of writing.

I love what you guys are usually up too. This kind of clever work and exposure! Keep up the excellent works guys I’ve you guys to my blogroll.

Trust me these things come in handy when you need them. Tom Zegan

Nicely put, Thanks.write my law essay college essay press release writing services

abstract art have share some of its unique beauty when it comes to art. i like abstract art because it is mysterious;;

I have acquired some new things from your website about pcs. Another thing I’ve always believed is that computer systems have become a product that each house must have for a lot of reasons. They supply you with convenient ways in which to organize homes, pay bills, search for information, study, tune in to music as well as watch television shows. An innovative solution to complete these tasks is a laptop computer. These personal computers are mobile ones, small, effective and easily transportable.

I really like your writing style, excellent information, appreciate it for posting : D.

Currently it looks like Drupal is the best blogging platform available right now. (from what I’ve read) Is that what you’re using on your blog?

paxil bipolar paxil ererectile dysfunction treatment

Great post.Really looking forward to read more. Keep writing.

Berkley Herrera

Thanks for the good writeup. It in fact used to be a leisure account it.Look complex to more delivered agreeable from you! However, how could wekeep in touch?

Thanks for the marvelous posting! I certainly enjoyed reading it, you will be a great author.I will make sure to bookmark your blog and definitely will come back very soon. I want to encourage you to continue your great posts, have a nice evening!

An interesting discussion is worth comment. I think that you should write more about this topic, it might not be a taboo matter but generally people don’t discuss such subjects. To the next! Kind regards.

Very good article.Really looking forward to read more. Fantastic.

Simply a smiling visitant here to share the love (:, btw great pattern.

Oh my goodness! an amazing article dude. Thank you However I am experiencing issue with ur rss . Don?t know why Unable to subscribe to it. Is there anyone getting identical rss drawback? Anybody who is aware of kindly respond. Thnkx

Xoilac Tv Trực Tiếp đá Bóng ca cuoc 365Đội tuyển chọn nước Việt Nam chỉ cần một kết trái hòa có bàn thắng để lần thứ hai góp mặt trên World Cup futsal. Nhưng, để làm được điều này

This is a very good tip particularly to those new to the blogosphere. Brief but very precise infoÖ Many thanks for sharing this one. A must read article!

Great blog article.Really thank you! Really Cool.

An interesting discussion is definitely worth comment. I do think that you ought to write more on this topic, it may not be a taboo subject but usually people do not speak about such subjects. To the next! Best wishes!!

Im thankful for the post.Much thanks again. Keep writing.

past, but we have heard of a lot All of the things we named falls

Your approach of clearing up done in this article is really great

order a paper online help with writing research papers

Hello mates, nice piece of writing and nice urging commented at this place, I am truly enjoying by these.

Pretty! This has been a really wonderful article. Thank you for supplying thisinfo.

I truly appreciate this blog post.Really thank you! Keep writing.

I really like what you guys are usually up too. Such cleverwork and coverage! Keep up the fantastic works guys I’ve you guys to blogroll.

Howdy! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?coin

Im grateful for the post. Cool.

What’s up i am kavin, its my first time to commenting anywhere, when i read this paragraph i thought i could also make comment due to this sensible piece of writing.

enxUjVXcUzznljompEzlJPPqfdw

Hi there! I could have sworn I’ve been to this blog before but after browsing through a few of the articles I realized it’s new to me. Nonetheless, I’m definitely pleased I found it and I’ll be bookmarking it and checking back regularly!

Hey! I could have sworn I’ve been to this blog before but after reading through some of the post I realized it’s new to me. Nonetheless, I’m definitely happy I found it and I’ll be bookmarking and checking back often!

Hello there! Would you mind if I share your blog with my zynga group?There’s a lot of people that I think would really enjoy your content.Please let me know. Many thanks

Amazing facts. Thank you.help in writing essay theses dissertations academic ghostwriter

Major thanks for the blog.Much thanks again. Really Cool.

pastilla sildenafil sildenafil time to work

I have not checked in here for some time since I thought it was getting boring, but the last few posts are great quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

hydroxychloroquine and zinc hydroxychloroquine sulfate tablets

Thank you for your blog post.Really thank you!

ivermectin paste tractor supply ivermectin steroids

Thanks for the blog.Thanks Again. Really Great.

Amazing! Its actually amazing post, I have got much clear idea on the topic of from this piece ofwriting.

I do accept as true with all the ideas you’ve introduced for your post. They’re really convincing and will certainly work. Still, the posts are too short for newbies. May you please extend them a little from next time? Thank you for the post.

I was just searching for this information for a while. After 6 hours of continuous Googleing, at last I got it in your site. I wonder what’s the lack of Google strategy that don’t rank this type of informative web sites in top of the list. Generally the top sites are full of garbage.

Admiring the persistence you put into your blog and detailed information you offer. It’s good to come across a blog every once in a while that isn’t the same unwanted rehashed information. Excellent read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

I wanted to thank you for this very good read!! I definitely enjoyed every bit of it. I’ve got you saved as a favorite to look at new things you postÖ

Thanks for some other fantastic article. Where else may just anybody get that type of information in such an ideal approach of writing?I’ve a presentation next week, and I am at the look forsuch info.

Thanks for sharing, this is a fantastic post.Much thanks again. Much obliged.

Hey! I simply want to give an enormous thumbs up for the good data you have got right here on this post. I shall be coming again to your blog for extra soon.

Never underestimate what the power of having good relationships can do.

Hello.This post was extremely remarkable, particularly since I was browsing for thoughts on this subject last Friday.

Major thanks for the blog.Thanks Again. Great.

I wanted to thank you for this good read!!I definitely enjoyed every bit of it. I have you bookmarked to look at new things you post…

On Sale Generic Fedex Macrobid Tablets Medication

Heya! I just wanted to ask if you ever have any problems with hackers?My last blog (wordpress) was hacked and I ended up losing a few months of hard work due to no data backup.Do you have any solutions to stop hackers?

A motivating discussion is worth comment. I think that you should publish more on this issue, it may not be a taboo subject but typically people don’t talk about such topics. To the next! All the best!!

Hi, I do believe this is a great blog. I stumbledupon it 😉 I will return once again since I book marked it. Money and freedom is the best way to change, may you be rich and continue to help others.

Thanks for these useful thoughts! This is another quality post from you.

I do agree with all the ideas you’ve offered in your post.They’re really convincing and will definitely work.Still, the posts are too short for starters.Could you please extend them a little from next time?Thank you for the post.

Thanks for your valuable post. As time passes, I have come to be able to understand that the particular symptoms of mesothelioma cancer are caused by a build up associated fluid involving the lining of the lung and the chest cavity. The illness may start while in the chest spot and multiply to other body parts. Other symptoms of pleural mesothelioma cancer include weight-loss, severe inhaling and exhaling trouble, nausea, difficulty ingesting, and swelling of the neck and face areas. It should be noted that some people with the disease usually do not experience almost any serious symptoms at all.

Nice post. I was checking continuously this blog and I’m impressed! Extremely helpful info specifically the last part 🙂 I care for such info a lot. I was looking for this particular information for a very long time. Thank you and good luck.

Thank you for sharing excellent informations. Your site is very cool. I’m impressed by the details that you?ve on this blog. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my pal, ROCK! I found simply the information I already searched all over the place and just could not come across. What a great site.

Colin Elliott

Thanks so much for the blog article.Really thank you! Will read on…

Whats up! I simply would like to give an enormous thumbs up for the nice data you will have right here on this post. I will probably be coming back to your weblog for more soon.

I loved your post.Much thanks again.

I cannot thank you enough for the article post.Really looking forward to read more. Awesome.

I appreciate you sharing this article post.Much thanks again. Awesome.

I appreciate you sharing this article post.Really looking forward to read more. Will read on…

I used to be very pleased to find this net-site.I wanted to thanks in your time for this wonderful read!! I positively enjoying every little little bit of it and I have you bookmarked to check out new stuff you weblog post.

Deacon Love

I’m in awe of the author’s talent to make intricate concepts accessible to readers of all backgrounds. This article is a testament to his expertise and dedication to providing useful insights. Thank you, author, for creating such an captivating and illuminating piece. It has been an unforgettable experience to read!

Nice blog here! Additionally your web site rather a lot up very fast! What host are you using? Can I get your associate hyperlink on your host? I wish my site loaded up as fast as yours lol

Thanks a lot for the helpful content. It is also my opinion that mesothelioma cancer has an incredibly long latency phase, which means that the signs of the disease won’t emerge right up until 30 to 50 years after the first exposure to asbestos. Pleural mesothelioma, that is the most common form and has effects on the area about the lungs, could potentially cause shortness of breath, upper body pains, including a persistent cough, which may bring on coughing up blood vessels.

Through my investigation, shopping for electronics online can for sure be expensive, nonetheless there are some how-to’s that you can use to obtain the best discounts. There are generally ways to obtain discount specials that could help make one to buy the best technology products at the lowest prices. Interesting blog post.

Wow, great blog.Much thanks again. Much obliged.

Güvenilir bir medyum için bizi tercih ediniz, medyum haluk hocamız sizler için elinden geleni yapıyor.

Very good blog post.Thanks Again. Great.

Hey, thanks for the blog.Thanks Again. Cool.

Freya Gibbs

I have noticed that smart real estate agents all around you are Promotion. They are recognizing that it’s not only placing a sign post in the front area. It’s really concerning building connections with these retailers who later will become consumers. So, after you give your time and energy to encouraging these suppliers go it alone – the “Law involving Reciprocity” kicks in. Thanks for your blog post.

This is a topic that is close to my heart… Best wishes!Where are your conttact details though?

I’m not sure where you’re getting your information, butgood topic. I needs to spend some time learning more or understanding more.Thanks for wonderful info I was looking for this information for my mission.

There as definately a great deal to know about this issue. I like all the points you ave made.

I’m really enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a designer to create your theme? Exceptional work!

A library of sources for student athletes and those seeking a profession in the sports industry, including sports media.

vurcazkircazpatliycaz.ACoB0FFsAI4k

I really like what you guys tend to be up too. This kind of clever work and reporting!Keep up the great works guys I’ve incorporated you guys to my personalblogroll.

vurcazkircazpatliycaz.1k3P0sLA50mn

obviously like your web site however you need to take a look at the spelling on quite a few of your posts. Many of them are rife with spelling problems and I in finding it very bothersome to tell the reality nevertheless I?ll certainly come again again.

hi!,I like your writing so much! share we communicate more about your article on AOL? I need an expert on this area to solve my problem. May be that’s you! Looking forward to see you.

It is actually a nice and helpful piece of info. I am satisfied that you just shared this helpful information with us. Please stay us up to date like this. Thank you for sharing.

another name for hydrochlorothiazide lisinopril for diabetes

vurucuteamgeldi.sFCcQipywtjR

Heya i’m for the primary time here. I came across this board and I in finding It really helpful & it helpedme out much. I’m hoping to offer one thing back and aid others such as youaided me.

Hey There. I found your blog using msn. This is a very well written article.I will make sure to bookmark it and return to read more ofyour useful info. Thanks for the post. I will certainly return.

I will immediately take hold of your rss as I can not to find your email subscription linkor newsletter service. Do you have any?Kindly permit me recognize in order that Icould subscribe. Thanks.

Hello There. I found your blog using msn. This is a really well written article. I?ll make sure to bookmark it and return to read more of your useful info. Thanks for the post. I will definitely return.

daktilogibigibi.OBL5hxLegPBE

daxktilogibigibi.ZAEVop99fsMV

Thanks for the blog. Awesome.

daxktilogibigibi.Gb8G34OlgRRv

It is actually a great and helpful piece of info. I am happy that you simply shared this useful information with us. Please keep us informed like this. Thank you for sharing.

kamagra pills: erectile dysfunction pills ed pills

Another important aspect is that if you are a senior citizen, travel insurance for pensioners is something you must really look at. The older you are, a lot more at risk you will be for making something bad happen to you while in another country. If you are definitely not covered by several comprehensive insurance plan, you could have quite a few serious complications. Thanks for discussing your ideas on this blog.

I really like what you guys are usually uptoo. This sort of clever work and reporting! Keep up the fantasticworks guys I’ve incorporated you guys to my personal blogroll.

where can i get zithromax over the counter zithromax generic – zithromax over the counter

Excellent post. I was checking constantly thhis blog andI’m impressed! Extremely helpful infgormation particularlythe remaining part 🙂 I deal with such info much. I waas seeking thiscertain information for a long time. Thanks and bestof luck.

A fascinating discussion is worth comment. There’s no doubt that that you need to publish more on this topic, it might not be a taboo subject but usually people do not talk about these subjects. To the next! Kind regards!!

Thank you ever so for you blog article.Really thank you! Great.

オンラインカジノとオンラインギャンブルの現代的展開